Van Finance Deals - Vans on Finance

Vans on Finance In North Cheam, Sutton, London

Our Van Finance Deals and Leasing Offers Are On Vans That Are In Stock Now! From £169 A Month!

Choosing a new commercial vehicle for your business requires careful consideration. Not only do you need to make a great first impression, but you also have to consider practicality, economy and, of course, affordability.

What is Vehicle Financing?

Vehicle financing or car finance agreement is an agreement between two parts where one lends an amount of money to the other with the purpose of purchasing a car or van. The money will have to be returned with interest over a period of time, as mentioned in the contract.

Van Finance Deals Available:

Here at Loads of Vans, we aim to make driving away in your new van as simple and affordable as possible. That’s why we offer a range of fantastic finance leasing deals on our vehicles. Choose from Finance Leasing, Hire Purchase (HP), Business Contract Hire (BCH) or Lease Purchase and benefit from our tailored packages that are designed to suit your needs and budget.

Our finance specialists can talk you through the benefits of each option and advise on which would be the best for your business. Whether it’s a van that you own at the end of the agreement or one you can return at the end of the contract, you can be sure your requirements are catered to. All our vans on finance come with quality assured, meaning you can be certain you’ll drive away happy. Explore our available options and find the best finance for your organization.

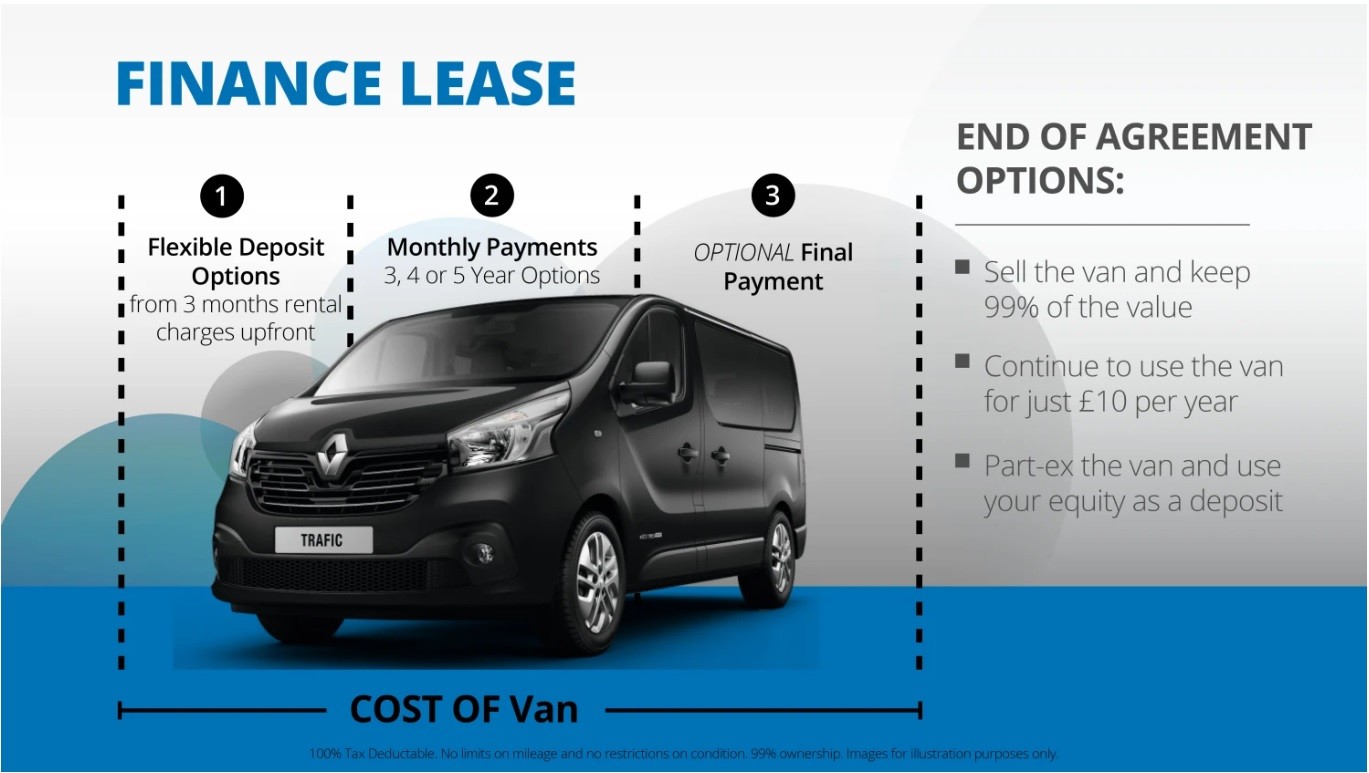

Van Finance Leasing

Leasing is one smart way to upgrade to a new vehicle without any hassle. You have all the benefits of ownership, you get your van for less and at the end of the contract you can simply upgrade again to a newer vehicle and keep up with the times for matters such as emissions rules or switching to electric. Usually, it’s over a period between 36 – 72 months with fixed payments and a deposit required. However, there are plenty of van finance options with 0 deposit that you can access. Here are the pros and cons that you must be aware of, before signing a leasing agreement:

PROs of Van Finance Leasing: | CONs of Van Finance Leasing: |

|

|

>>>

Do you want to know more about this type of finance deal? Visit our van finance lease page where we go more into detail about this option or watch the video below.

The benefits of this agreement for you:

Should I buy or lease a van?

Of course, leasing a van comes with many benefits, but it’s not always the best solution in some circumstances. That’s why, to help you make the best decision, we compare these two finance options in our article Should You Buy or Lease a New Van?

Van Leasing Offers |

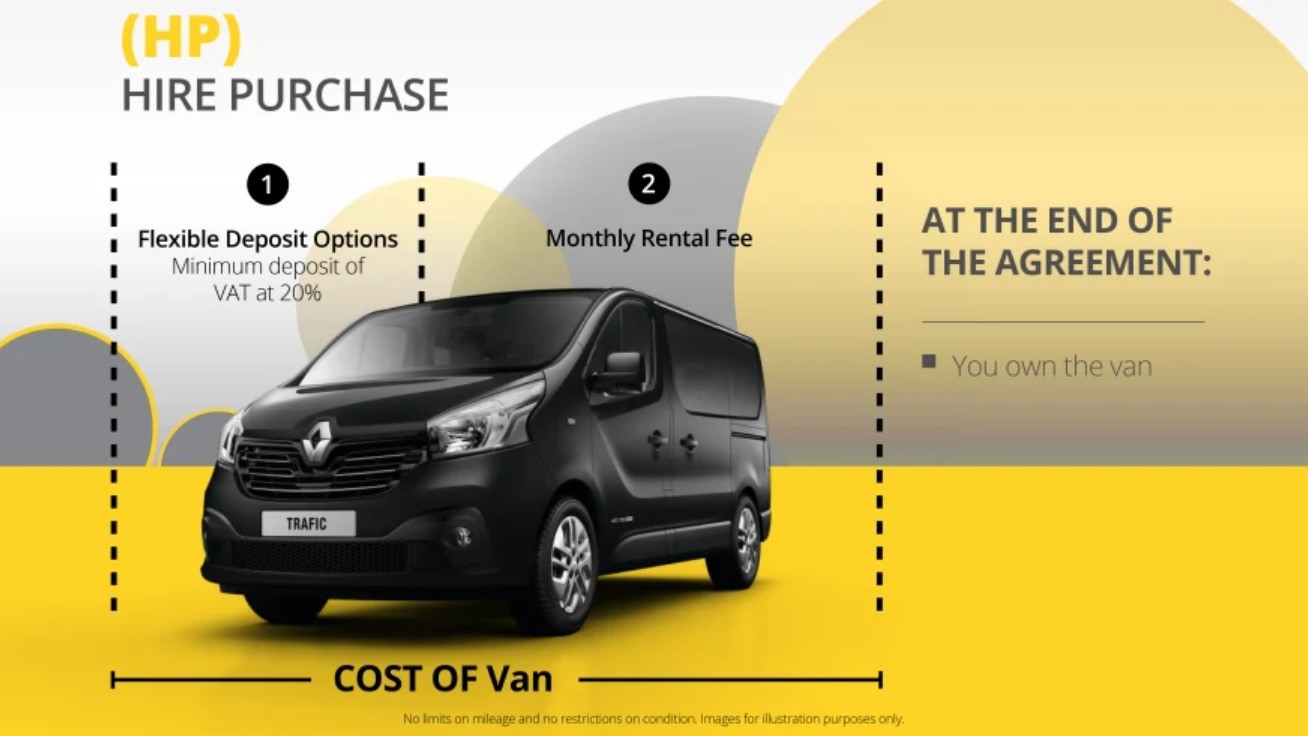

Van Hire Purchase (HP)

This financial package allows you to own the vehicle at the end of the agreement. The cost will be spread over a period of up to 60 months, but a minimum deposit will be required representing the upfront VAT and road fund licence. VAT registered companies will be able to reclaim the deposit. The vehicle will be used as security against the van finance. Here are some of the pros and cons that you may want to know before choosing this option:

Hire Purchase PROs: | Hire Purchase CONs: |

|

|

>>>

To find out if this is the right type of finance for you, visit the Van Hire Purchase and have your questions answered.

Is a Hire Purchase worth it?

In short yes, if you don’t have immediate funds or wish to spread the cost over a certain period. The finance lender is the legal owner until the loan will be fully repaid, transferring the ownership to you after the last payment was made.

Business Contract Hire (BCH)

Similar to hiring a car but for a longer period, van contract hire allows you to hire a van for an agreed period, with a mileage limit and a fixed monthly amount to pay. This is determined by the contract length, the car value and your mileage estimation throughout the contract. It’s a cost-effective way to drive the van you require but maybe not be able to buy right now and at the end of the contract, you simply return it to the lender.

Contract Hire PROs: | Contract Hire CONs: |

|

|

>>>

To better understand this type of financing and how well it suits you, read more on our Contract Hire vans page.

Is Business Contract Hire a good idea?

Although it comes with a set of benefits and downsides, business contract hire is the most suitable for companies in need of large fleets, due to the fixed low initial rental paid. This way will be easier to plan the budget and more money can be directed to different sectors of the business.

Lease Purchase (LP)

This option is also known as Hire Purchase finance with a balloon payment – low monthly fees plus one final payment to complete the total amount payable. It’s an affordable method to pay for a van, cheaper and more flexible than Hire Purchase (HP) or Personal Contract Purchase (PCP), as you can adjust the monthly fees and the balloon payment accordingly to your budget. However, keep in mind that this package is restricted to a 4-year term.

Lease Purchase PROs: | Lease Purchase CONs: |

|

|

>>>

Read our van finance FAQs to make sure you have all your questions answered:

Can you buy a van on finance?

For many people, a van loan is a great alternative since it allows one to buy a van without having to pay the whole amount upfront. However, you have to be eligible to obtain a van finance deal.

Is it hard to get finance on a van?

Van financing is a process similar to a bank loan or credit card, no matter if you are self employed or you represent an organisation. If you have a good credit history, the lender will determine whether you can afford the payments throughout the contract.

Can I get van finance if I’m self-employed?

In short, yes, but there are a few conditions to be met. Your company must be officially registered and at least two years of trading. We discuss this subject in detail in our Van Finance for Self-Employed - Loan & Leasing Guide.

Do you pay VAT on van finance?

Usually, a commercial vehicle often requires a minimum deposit equal to the FULL VAT of the van's purchasing price. It can be claimed back if your company is VAT registered.

Can I lease a van if not VAT registered?

Yes, you can. You don’t need to be VAT registered to access van deals. There is a wide range of accessible alternatives, each one with different options when terminating the contract, tailored to your company's needs.

Can I sell my lease van?

Yes, you have the choice to resell your van after your van finance contract ends. The van might be privately advertised and sold on behalf of the lende.

Is it better to Lease or Hire Purchase?

The difference between the two is how much you pay and when you pay it. Overall HP may be more cost-effective when larger monthly payments are affordable to you because the cost will be paid off sooner and less interest as a result.

What are the documents and details required for finance?

- Your personal details - name, DOB, marital and residential status and address history.

- Identity proof – a valid Passport.

- Proof of address

- UK driving licence (valid)

Is Guaranteed Van Finance Possible?

No matter if you have a bad or good credit rating, the truth is that no company, trader or lender can offer guaranteed van finance. To be able to offer their clients finance for vans, lenders have their own criteria to follow before making a decision. Some of the factors that influence their decision include the deposit paid upfront, your rating and circumstances, and your affordability. To avoid irresponsible lending that could cause more problems for both, lenders will have to make sure you can afford to repay the loan you will get. Therefore, finance for vans can not be guaranteed and we highly recommend you to be aware and consider all the risks you may be exposed to before working with any finance lender.

Why should you choose us?

We have designed our van finance deals and agreements to be as adaptable as possible, making it simple for you to plan your budget and get the best and most suited van for your company, with the option of paying it over a predetermined period. We are one of the oldest and most trusted vans dealerships in London. If your activity requires driving a new or used vehicle, you will find a wide range of options to choose from, as well as different types of finance that can be tailored according to your needs.

We work with big auto brands like Citroen, Peugeot, Nissan, Volkswagen, Ford, Fiat, Vauxhall and we take pride in our impeccable services.

If you still require more details or information regarding the numerous alternatives and benefits each option has or simply wish to request a finance quote, get in touch with us today and one of our financing members will be more than happy to help you choose the best financing deal for you.