Van Leasing - Lease Vans - Get the best deals

Van Leasing in Sutton London

A Van Leasing agreement allows you to lease vans for a limited period of time, with the possibility of selling them when the contract ends and having a share in the sales proceeds. The agreement is between the leasing company and the client and it’s most suited for VAT-registered companies because it pays the usage of the vehicle and not the ownership.

It is the client’s responsibility to sell the vehicle to a 3rd party for the current market price. Although there aren’t any type of penalties relating to the van’s condition or mileage, it can be sold for a better price if it’s well maintained. However, the van must be in roadworthy condition.

Van Leasing Offers |

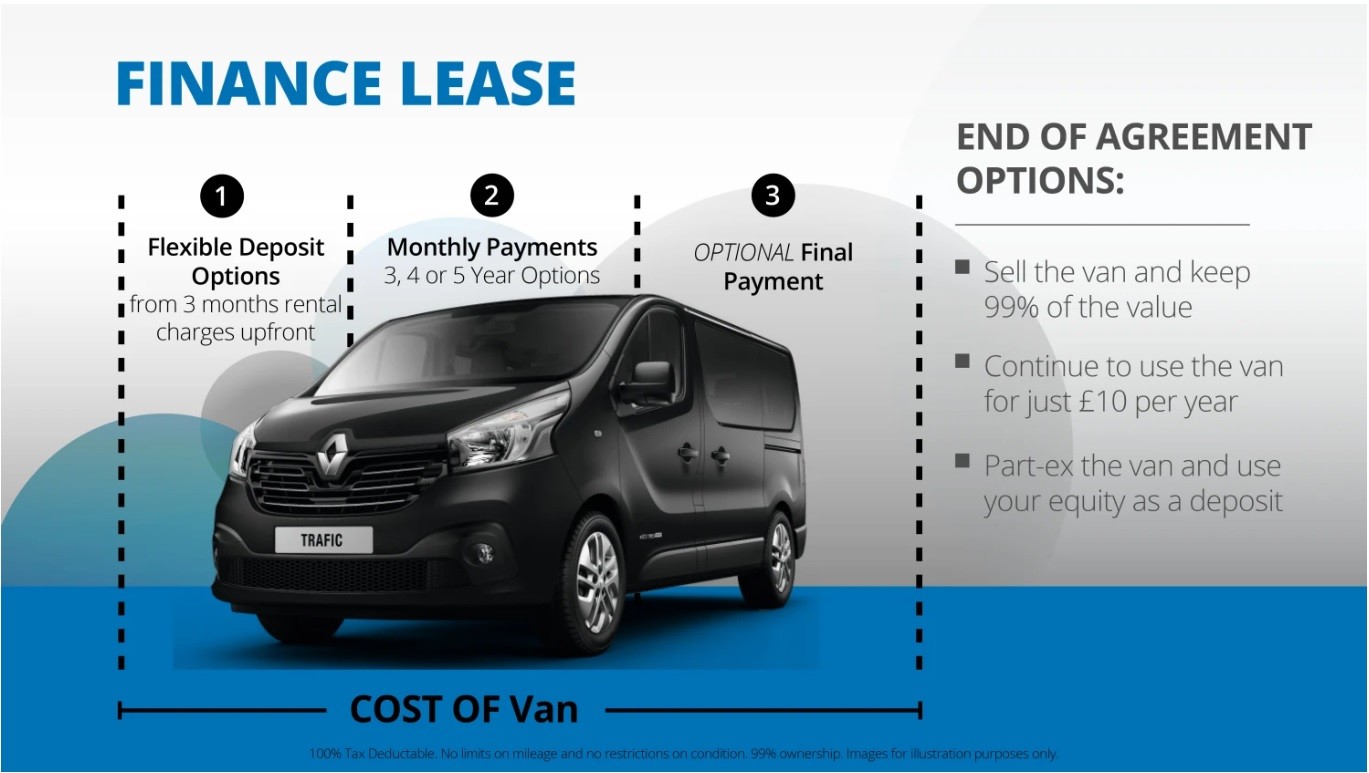

How do you pay for your Finance Lease?

There is a minimum of 3 months rentals deposit (around £1200 +VAT) and fixed monthly payments spread across the duration of the contract. The interest rate will be fixed, and the van will have to be insured.

Additionally, a balloon payment can be added to mitigate the monthly rentals and differ a part of the total cost to the end of the contract.

What happens at the end of the leasing contract?

If you're VAT registered, using a Finance Lease is a flexible and tax efficient way to buy your next van without breaking the bank. You choose the van, but the finance provider retains ownership. You simply use it for the agreed period and at the end of this term you either:

- Sell the vehicle to a third party and keep 95% of the sale proceeds.

- Pay a one-off secondary rental and continue to use your van for a further 12 months.

- Part exchange the vehicle and use your equity as a deposit on your next van.

What are the main benefits of leasing?

- Cash Flow – you can use your van immediately whilst allowing payments to be made on a monthly basis, providing your business with better cash flow.

- Repayment period flexibility – you choose a finance lease repayment period of up to 60 months.

- Fixed monthly repayments – your monthly repayments are fixed for the whole term of the agreement.

- Low monthly repayments – you choose the deposit you put down, but the more you pay, the lower your monthly repayments.

- Tax advantages – if you're VAT registered, you can reclaim the VAT payments made within the monthly payments.

- Tax relief – you can offset 100% of the monthly repayments against taxable profits.

- Mileage restrictions – No mileage restriction unless you opt for a terminal rental in which case only a mileage estimation is used.

- Equity – you retain approximately 95% of the equity in the vehicle.

The benefits of this type of agreement explained - video

Can you settle a Van Leasing agreement early?

Yes, you can terminate your van leasing at any time. However, a settlement figure will be calculated and paid before the van is sold. The further into the agreement the lower the settlement figure will be.

Who is this type of deal suitable for?

The finance lease package suits best the companies that wish to have different options when the agreement ends, require no ownership of the car or van or be tied to a contract. It is a great option if the business wants to claim tax refunds or sell the car and benefit from it.

How can we help you find the best van finance options for your business?

At Loads of Vans in North Cheam, Sutton, we can help businesses of all sizes find the very best value models and finance lease options for their needs at prices that are affordable. For example, you’ll find models such as the renowned Vauxhall Vivaro, Renault Trafic or Volkswagen Transporter available in our van leasing offers. Simply choose the size of your deposit, specify the length of the agreement, and estimate your annual mileage so that we can present you with a cost for leasing the model.

Our leasing arrangements have been tailored to be as flexible as possible, making it easy for you to budget for the van of your choice over a fixed period. A member of the finance team at Loads of Vans will be happy to talk through the various options available to you and discuss the many advantages that a leasing deal provides.

Whether it’s a solitary vehicle for your start-up business, or a fleet of vans for your national organisation, choosing a leasing deal with Loads of Vans is a cost-effective way of investing in the very best commercial models available.

Read some of the most frequently asked questions on van leasing and their answers in the section below:

· Can I get a van on finance for my business?

Yes, you can. With a business finance lease deal, you gain access to a new van in exchange for regular monthly payments. There are different types of financing, depending on your circumstances. Make sure you are well informed before you decide which one is the best.

· Is Finance Leasing a good option?

Finance Lease is one of our most desired finance options for companies that want to expand their fleet or simply are in need of a new van or car. It comes with a set of tax benefits and flexible options for qualifying businesses that lack the available finances to pay the whole amount upfront.

· Can I lease a van if not VAT registered?

You do not have to be VAT registered to have the possibility to lease a van. There are different types of lease agreements depending on how the contract ends and what happens with the vehicle after.

· Do you own the van when the leasing ends?

With a lease agreement, you won’t have the van’s ownership. The finance company receives the final balloon payment at the end as agreed in the contract and the van will be sold after.

· What do I need to lease a van for my business?

The documents required for leasing a van for a business are the owner’s valid ID (passport or driving licence), the business director's details, the business details (address, status, registration number and VAT), the annual net income or a bank statement going back at least three months.

· Why can't I buy my leased car?

This type of contract will not permit you to purchase the leased car when the leasing contract ends and that is due mostly to the financial agreement structure that the legal owner (in this case the lesso) has chosen and its implications with VAT and HMRC. However, depending on the business and the circumstances, sometimes this feature may be possible.

· Can you lease a van for a year?

A 12-month van leasing contract is a popular solution due to its flexibility. There is no long-term commitment to being tied in with the leasing company and the monthly payments are more accessible as compared with van rental services.

· Can I sell my lease van?

Once your leasing contract ends, one of the possible options is to sell the vehicle on behalf of the lessor. It can be advertised privately and after the transaction, you will keep 95% of the sale proceeds.

· Can I lease a van if I’m self-employed?

Yes, this is possible. A Finance Lease deal is a popular option for sole traders, with plenty of benefits like tax reduction and sometimes it can be cheaper than buying. To achieve this, you must pass a credit check, calculate your budget and decide upon the van that you need. Read all you need to know in our article on finance for self-employed.

· Can I lease a van with a new Ltd company?

Yes, a new business can access business leasing deals. However, you will still need proof to confirm that the company is able to pay the monthly rentals as well as some trading history.

· What's cheaper lease or finance?

If you choose a loan, the monthly payments are often higher than the monthly rentals of a lease deal. For a loan, there are 3 factors influencing the payment – sale price, interest rate and length of the contract. For a lease deal, the influencing factors will be the sales price, length of the lease, mileage in some cases, residual value, rent charge and other taxes and fees.

· What are the disadvantages of leasing?

The lack of equity in the leased vehicle is the main disadvantage of leasing. Despite making regular payments, you won’t be entitled to own the vehicle after the contract has ended.

· Can I extend my van lease?

Yes, it is possible. One of the options available after ending your contract is to pay a one-off secondary rental and utilise your van for an additional 12 months. The type of your lease agreement and your leasing company will ultimately determine this.

· Who owns the asset in van leasing deals?

In van leasing deals, the leasing company will be the legal owner of the asset, purchasing and renting it to the user for the duration of the agreement. The user (lessee) will support any risk or benefit associated with the vehicle.

· Can I claim tax back on a leased van?

Yes, you can claim it back 100%. This is possible due to the fact that the vehicle is rented, not owned, meaning that it’s an ongoing expense and taxes are deductible.

· Do lease vans come with insurance?

As standard, it is your responsibility to ensure the leased vehicle, thus van insurance is typically not included in the lease agreement or its monthly rentals.

· Is it better to lease or buy a car if self-employed?

A good leasing deal for a car usually has several advantages over purchasing it. Since monthly payments are fixed, calculating the budget and managing the cash flow will be easier.

· Why leasing a vehicle is smart?

Simply because there is just a single monthly payment for driving a brand-new car, that is manageable and includes the breakdown cover, warranty and road tax. It can be cheaper than buying the vehicle and for VAT registered companies, it comes with other tax benefits.

· Is leasing the same as hire purchase?

The main difference is at the end of the contract – when the leasing agreement ends, the vehicle must be sold to a 3rd party. When Hire Purchase ends, you can purchase the car or van if you wish to. Leasing is great for driving a new car and hire purchase is more suitable for used cars.

· Is there VAT on leasing payments?

Yes, new cars pay VAT across the length of the agreement – 20% of the vehicle’s value. However, if your company is VAT registered, this can be claimed back.

· What other van leasing deals are available?

Lease Purchase is another van leasing agreement, conditioning the user to take possession of the van once the last payment was made. However, the monthly rentals are similar to a lease agreement.

Work with us

We hope you find this guide useful. Find out more by getting in touch with a member of the finance team at our dealership today, that will be more than happy to help you find the best van lease deals. You can contact us by submitting an online enquiry, using our live chat functionality, or by picking up the phone to speak to us directly and request a quote! Well-located for those working or living in London, you can catch the underground to nearby Morden station or follow the A3 or A24 to North Cheam.

Is van leasing not the best option for you? Try Hire Purchase, Contract Hire or visit our van finance deals page and see what other options are available or get in touch with us so we can help you get the best deal for your van.